This story appears in the January 2026 issue of Utah Business. Subscribe.

In the venture world, major shifts are underway in where and how capital is being invested. These changes are particularly evident in the Utah ecosystem, which has primarily invested in software, commercial and consumer goods over the last decade. But how exactly do the numbers shake out, and what have been the trends over time? Let’s look at the data.*

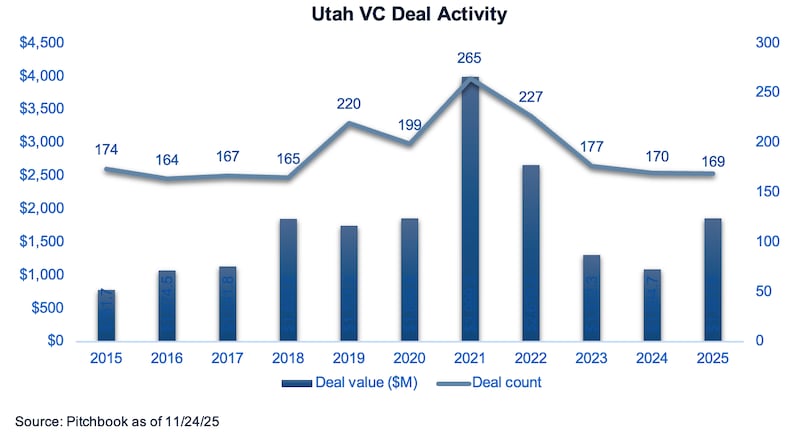

Deal value rebounds while round sizes shift upmarket

In 2025, total Utah deal value rebounded sharply to $1.86 billion, the first yearly uptick since the 2021 peak, despite deal count coming in just below 2024 at 169 transactions. The Utah investment economy reflects a national trend toward fewer but larger, higher-conviction rounds.

The composition of activity shifted up-market, with late-stage and venture growth deals together accounting for nearly 40 percent of all invested capital, the highest share in the past decade, signalling that Utah companies are successfully scaling and attracting significant follow-on capital. At the same time, pre-seed and seed activity fell to 27.4 percent, its lowest percentage since 2017, underscoring a higher bar for companies raising their first checks.

Early-stage VC rebounded modestly to 33.3 percent (up from 23 percent in 2023), suggesting investors are selectively re-engaging once traction is proven. Overall, 2025 reinforces Utah’s evolution from an emerging startup hub into a maturing venture ecosystem that is increasingly defined by durable companies, larger rounds and later-stage outcomes rather than sheer early-stage deal volume.

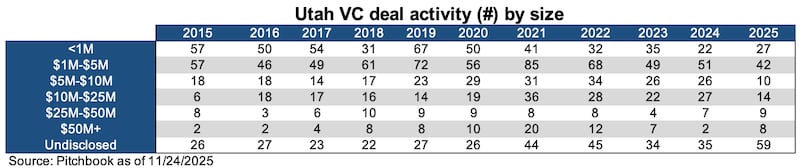

Polarized funding landscape shows preference for early bets or clear winners

Utah’s 2025 venture deal-size data highlights a continued bifurcation of the market, with fewer mid-sized rounds. Sub-$5 million rounds remained the backbone of Utah VC activity, accounting for 69 deals. In contrast, the traditional “middle” of the market softened: $5 million to $25 million rounds fell to 24 deals, their lowest level in nearly a decade. At the top end, $50 million+ rounds rebounded to eight deals, a meaningful uptick from 2024 and evidence that breakout Utah companies can still attract large checks. Overall, the data shows a Utah venture market that is selective, yet clearly favors either early bets or late-stage winners, with a dearth of capital to fuel growth rounds.

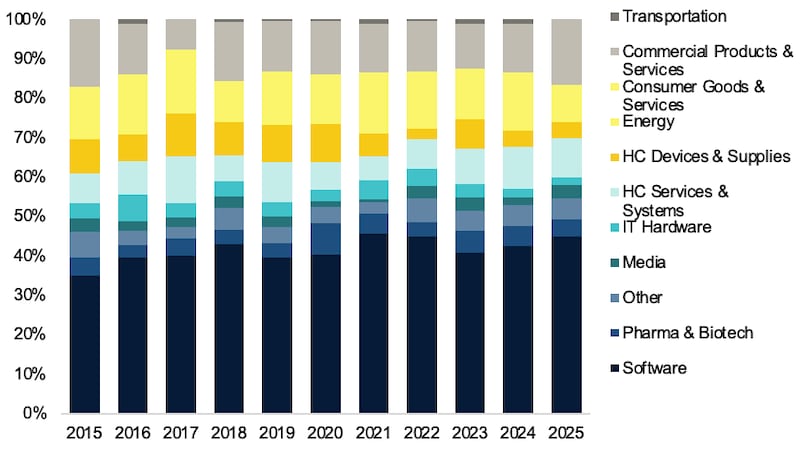

Software dominance continues while healthcare establishes strong secondary position

Utah’s 2025 venture activity by sector reinforces the state’s dominance in software, but also points to an increasingly diversified innovation economy. Software once again dominated deal count, but healthcare-related sectors remained a durable secondary pillar. The data pulled from Pitchbook did not categorize AI-specific investments, but overall, the 2025 data shows investors doubling down on enterprise, healthcare and commercial platforms.

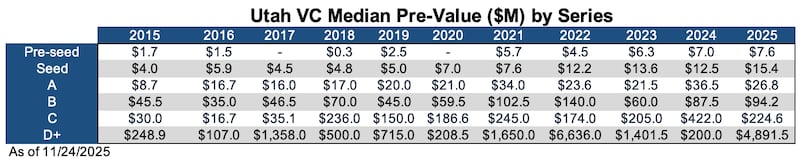

Valuations reveal selective market dynamics across funding stages

In 2025, pre-seed and seed median pre-money valuations climbed to record highs ($7.6 million and $15.4 million, respectively), while median check sizes remained relatively modest. Founders with strong traction can still command premium pricing, but must do so with capital efficiency.

Series A tells a more selective story: median deal size jumped sharply to $15 million, even as median pre-money valuations pulled back from 2024 highs, reflecting fewer but more conviction-driven A rounds. At the later stages, volatility dominated. Series B and C valuations rebounded meaningfully alongside larger check sizes, reinforcing that Utah companies able to reach durable scale continue to attract significant capital. Meanwhile, the dramatic swings in D+ valuations and deal sizes highlight the outsized impact of a small number of mega-rounds. Overall, the data underscores a Utah venture ecosystem that rewards traction, revenue and capital efficiency at every stage.

Utah’s future points toward AI and deep tech innovation

To have a better sense of where the capital will flow in 2026, I went straight to those closest to the action and asked several VCs across the Utah ecosystem to share their funds plans for investing in the next year:

“Over the last two decades, Utah’s technology sector rode the cloud and mobile wave, producing anchors like Qualtrics, Lucid and BambooHR. While the past was defined by SaaS, 2026 will be the year that the first crop of Utah-based, AI-native application companies break out. Large funding rounds led by top-tier VC funds into Utah AI companies will be announced, and these companies will become talent magnets like their SaaS predecessors. In 2026, Peterson Ventures will continue to focus on startups that don’t just provide tools but leverage AI to execute workflows as software evolves from systems of record to systems of action.” — Taylor Jones, Managing Partner at Peterson Ventures

“In 2025, we primarily invested in seed-stage startups that are either establishing AI data sets and/or agentic workflow solutions. As we kick off 2026, Stalwart Ventures will continue to focus on AI-related startups, as well as defense tech and robotics.” — Rachelle Morris, Managing Director at Stalwart Ventures

“Heading into 2026, we expect capital to continue concentrating around companies with clear paths to revenue, defensible technology and real customer adoption. Epic Ventures is leaning into sectors where Utah has structural advantages, particularly healthcare, life sciences, energy, security and enterprise software.” — Jack Boren, Managing Partner at Epic Ventures

“For 2026, Nucleus Fund is looking forward to continuing our focus on deep tech in Utah. We’re excited to see other local funds investing in deep tech, especially energy and defense, and expect this trend to continue. Utah is ready to step forward as a leader in these areas.” — Kristin Wihera, Investor at the Nucleus Fund

Collectively, investors are signaling that Utah’s next chapter will be defined less by incremental software advances and more by AI adoption and sector-specific deep technology. The SaaS era that produced category leaders has laid the foundation for Utah, but as capital tightens and expectations rise, Utah funds are aligning around companies that pair defensible technology with real-world adoption. As 2026 approaches, Utah appears eager to evolve from a SaaS success story into a national hub for AI-driven and deep tech innovation.

*All data was pulled from Pitchbook on November 25th, 2025. According to Carta, the busiest deal month in venture is December. It is highly probable that 2025 Utah deal values and counts have ended up significantly higher than what is disclosed here.

What do you want to know about the Utah VC scene? Do you have an investment that deserves a shoutout? Send inquiries and information to angela@nucleusutah.org.