Rather than selling to private equity, Central States Manufacturing sold the business to its employees. At the time of my reporting, the company boasted 47 millionaires — not just in the C-suite, but all the way down to drivers and machinists. That struck me as business done right.

The problems with capitalism have always seemed fixable to me — widespread inequality is caused by a bad equation, not the system itself. After all, salaries are often distributed equitably, with the C-suite earning, on average, just 5-15 times* more than the median worker in the U.S. The issue is when equity is not distributed equitably, with executives at private companies earning 174 times the median worker and those at public companies earning 290 times.

While the rest of the employees earn a static salary, equity holders see their wealth skyrocket. And with that wealth, they purchased more wealth in the form of stock, businesses and real estate. Wealth disparity at every company means wealth disparity in our country. That’s how we wound up transferring $79 trillion in wealth from the bottom 90 percent into the hands of the top 1 percent since 1975. Today, the wealthiest 10 percent of Americans own 92 percent of the stock market. The bottom half own 1 percent.

But companies are working hard to fix that equation. In Utah, Central States’ employee stock ownership plan (ESOP) and Clegg Automotive’s Employee Ownership Trust (EOT) base their stock allocation on salaries. If one worker earns 10 times more than the next person in salary, they earn 10 times more in stock value. That makes sense — after all, a salary is how much we think an employee is worth to the company. The value of corporate equity should then be divided up according to how much value each person contributed to it. Even Mark Cuban has come out in support of this model.

In trying to answer my long list of questions about how to fix the corporate equation across the board, I realized there was too much to cover in an article; I would need to analyze the research in a book.

How to fix capitalism

If I were interested in the publishing world, I might have pitched my book idea to an agent, who would then pitch it to a publisher. The publishing house might give me a book advance that could help fund the research, but like the rest of the capitalist world, the publishing industry operates on a bad equation. I was not interested in giving a publishing house and agent 85 percent of my earnings for a product that retails at $20. That’s a terrible deal, especially in a market where 96 percent of books sell less than 1,000 copies.

I had already completed some experimentation by this point — I serialized my first novel, sending out new chapters every week, charging a monthly subscription rather than a one-time sale. I earned $20,000 in subscription fees that year and gave a TEDx talk about the results.

Later, I crowdfunded a novella using Ethereum, with readers paying to own each chapter as an NFT (non-fungible token). I raised $5,000 from five readers. This year, I decided to test the market for my book, while also testing the thesis of it. If my goal is to create more owners of capital, maybe I should create more owners of my book.

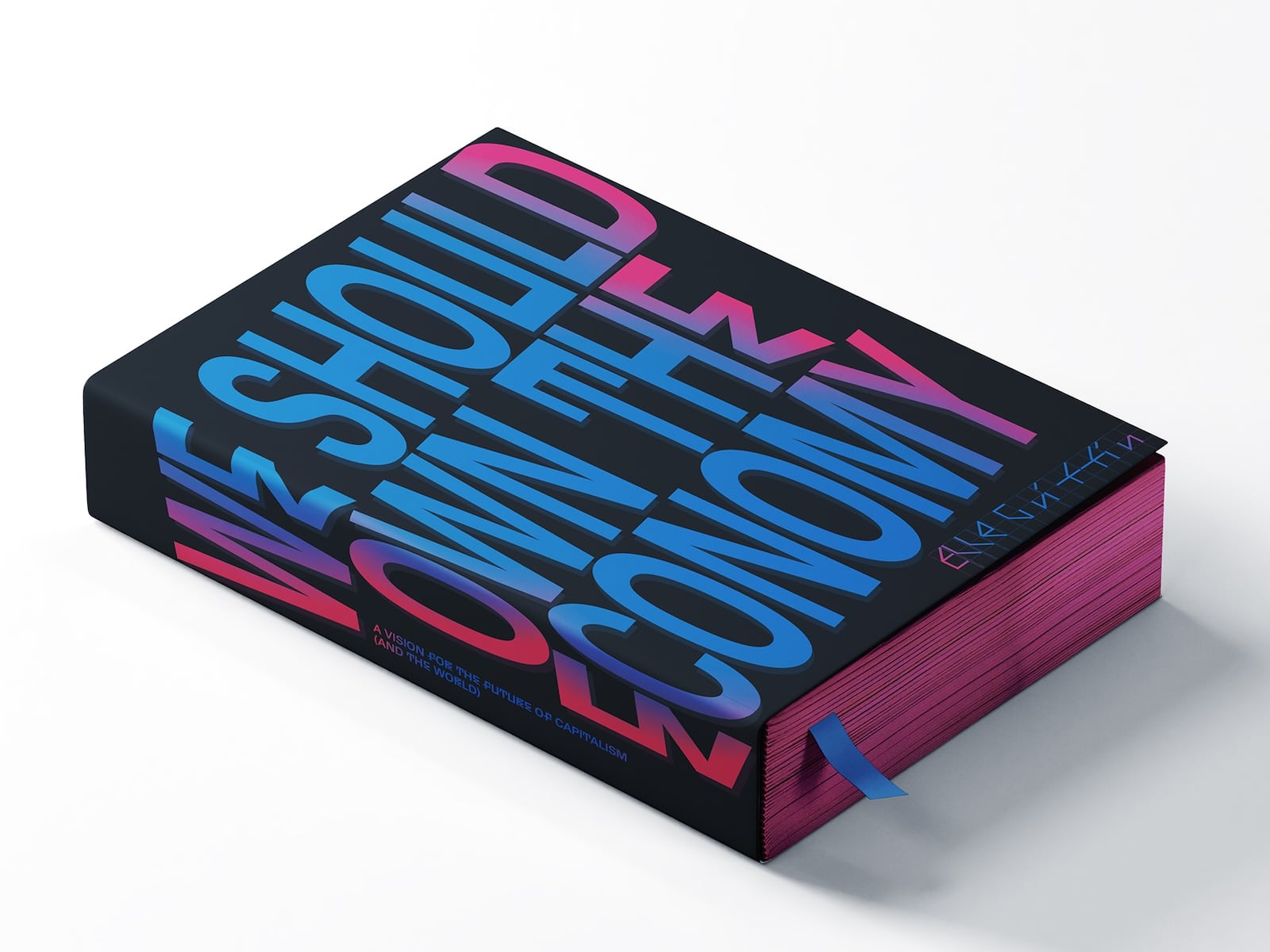

In February of this year, I launched my book project, “We Should Own the Economy,” on a crowdfunding equity platform called WeFunder. I invited readers to invest in the project and earn a share of sales when it sold. Pretty quickly, I raised an advance of more than $70,000 — not from a publishing house, but from 213 readers invested in seeing my book succeed. This aligned the incentives of my book with the incentives of readers who want to learn about the future of the economy — not the incentives of the publishing house, who want to make money.

Couldn’t the rest of our economy operate the same way? Could we create more owners of capital to similarly align the incentives of the economy with the incentives of all workers? Not just with the incentives of non-working investors and early employees?

Wealth inequality is caused by one thing: a bad equity deal. And, it keeps being a bad deal because those creating the equity programs ensure they remain the biggest beneficiaries of them.

But we know how to fix that, and we’ve fixed it once before. After WWII, the GI Bill created the greatest middle class in history. Millions of returning veterans bought homes through government-backed, zero-down, low-interest mortgages. They became owners of appreciating, income-generating assets for the first time and their wealth created country-wide prosperity. We shifted wealth into the hands of the many through homeownership.

We can do it again with business ownership. We need to.

Company by company, book by book, we can sell equity to the stakeholders that will most benefit from them; not just investors expecting a return. We can create more owners of our companies, our art, our technologies, our sporting teams. Businesses could be owned by employees, movies could be owned by fans, books could be owned by readers.

If all of us owned equity in our companies that were in proportion to what we contribute to their value, then our economy would benefit all of us. Not just the ones at the top.

And that’s a future of capitalism worth working toward.

About Elle Griffin

Elle Griffin is the founder of The Elysian and author of “We Should Own The Economy.” She writes about a better future and publishes collaborative print pamphlets, exploring the important ideas of our time. For her work, she was named an O’Shaughnessy Grantee, a Roots of Progress Fellow and a Substack Fellow.