Idid not think I would ever be a founder of a startup. As an active angel investor, I have funded women entrepreneurs for 20 years and witnessed first-hand how hard it is to build a company. So why, at the age of almost 60, did I feel it was the right time to found ShePlace and SheMoney? Simply put, I had to. It is said that every good play has three acts—a beginning, a middle and an end—and my SHE co-brands are my third act. It is where my story was always heading. It is a story about women, money and positive social change.

Before I dive into my story, here is a bit about these two brands: ShePlace is a network and digital platform designed for women+. Our in-person activities are currently in Utah, and our online network has about 28 states and 13 countries represented. SheMoney is a consultancy and content platform dedicated to supporting women+ on their journey to achieving financial wellness and freedom. We approach the topic of money through our newsletter, events, workshops and curated resources.

At ShePlace and SheMoney, we utilize “women+” to welcome and include all self-identifying women, including cis and transgender women, as well as non-binary and gender-fluid individuals. While our community and offerings are catered to women+, we welcome the support of all allies who share our values.

Now, how did ShePlace and SheMoney come to be? My journey began at a hockey concession stand in 1977.

Act I

I grew up in a small town in Canada called Kelowna. I had hard-working, awesome parents, and my sister and I are first-generation university graduates. We were a middle-class family with enough, but we only had enough because both of my parents worked their butts off to provide for us.

My first job was working at a concession stand at the local hockey arena, an awesome job for a 13-year-old, hockey-loving Canadian girl. I did the mental math for orders all shift long, was paid a decent hourly wage, met a lot of boys and had access to free popcorn and pop while I worked.

I had a very positive early experience with money and math. I was confident with both from a young age, which made a massive difference in why I ended up having the career I did. This confidence followed me from job to job, and I saved most of the money I earned. I was very money motivated, always. I graduated top of my class academically and was also a two-time Canadian junior bodybuilding champion.

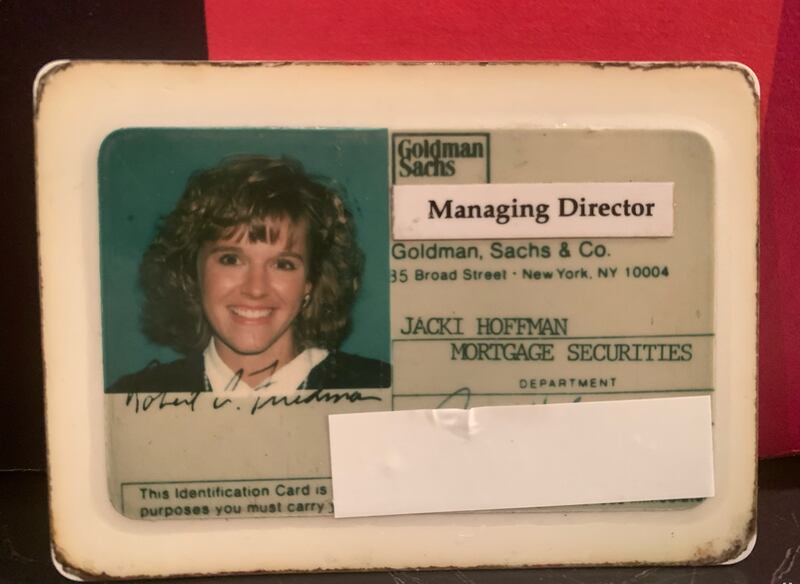

I was a finance major in college, and after graduating from The University of British Columbia in 1988, I moved to New York City to work for Goldman Sachs. I still remember my first day. I arrived very early for my 9 a.m. start time and sat on a bench outside 85 Broad Street in downtown Manhattan, wondering how someone from a small town in Canada could ever end up here. But I was there, and it was at this most prestigious Wall Street firm that I learned about financial instruments and markets, economic systems and the power of money.

I received many big paychecks while working for Goldman, but I also knew I was underpaid at different points of my career relative to some of my male peers. I had to learn to self-advocate and realized the importance of finding a sponsor.

As one of few women on the trading floor at the time, I played a role in creating Goldman’s first women’s network in the mid-90s. I worked in fixed income, and women were vastly underrepresented in many of the “producing” roles, especially in trading, which is what I did.

I think it is hard for people who have not experienced it to understand what it may be like to work as a non-majority person—whether by gender, race or other factors—in a majority culture, especially one that might be called a hyper-majority culture. The trading floor at Goldman Sachs was very male-dominated, and while most of the people I worked with and for were fantastic, some were not.

Unfortunately, I experienced some extreme sexual harassment by a superior at one point in time, and I know I wasn’t the only one. That experience helped me recognize the need for separate spaces where women could share their experiences, be supported, enhance their professional skills and step into power. The equation “women + money + community = power” was the foundational learning I carried forward into all that followed.

I went from my starting position as an analyst in 1988 to the youngest woman and first female trader to make partner in just eight years. As far as I am aware, over 25 years later, I still hold that record. I was very fortunate to be one of 221 partners, 13 of whom were female when the firm went public in 1999.

I was 35 years old at the time, married, the mother of a toddler, and suddenly set for life financially. I had the experience of a massive liquidity event, which meant having the financial freedom to do what I cared about doing in life. The seed was planted, and I was all-in on supporting other women in having that opportunity as well.

In 2002, I left full-time work at Goldman Sachs to pursue other interests. I learned so much, and my purpose was to take those learnings, which included my financial knowledge and resources, into my next act.

Act II

After leaving Goldman, I decided to learn everything I could about wealth management and investing. I did that via Circle Financial Group, a women-led multi-family office. As a high-net-worth individual, I had unique access to products and services and wanted to be a responsible fiduciary of our family’s assets.

Though I had a 14-year career at Goldman and understood a lot about the capital markets, especially from a global-macro perspective, I spent little to no time investing my personal money. My focus had been on earning, not investing.

I quickly learned the industry was, and still is, incredibly male-dominated, especially regarding who made decisions around where capital was being directed. We had countless public equity, private equity, bond and hedge fund managers present to us. Almost without exception, they were male. I was left asking, “Where are the women?”

I made it a mission to find women managers to invest in, and while I found some, they represented less than 2 percent of the managers out there. I also started investing directly in women entrepreneurs, as I was very aware of how little funding went to female founders.

At the same time, I embarked on a journey into philanthropy that lasted for two decades as the primary area where I spent time. As a grantmaker, I was excited to learn how to create positive change in the lives of women and girls, and I joined the boards of many women-led and women-serving organizations.

I also joined a campaign called Women Moving Millions (WMM), whose mission was to encourage high-net-worth women to make gifts to women-led nonprofits.

Following the campaign, I stepped into a leadership role to transition WMM into an ongoing organization and was later recognized as co-founder for my contributions. It remains the largest community of women funding women and has catalyzed over one billion dollars in giving.

During my time at WMM in 2010, our family moved to Utah. One of the primary reasons we chose Utah was because of the direct flights back to New York. Life was so busy with kids and my work, yet I missed a sense of community with other professional women in my home state.

I was fortunate to meet Salt Lake City local and accomplished film producer Geralyn Dreyfous of the Utah Film Center and Impact Partners when I first moved here. Together with David Parkinson of Method Communications and Jennifer Danielson, now with Collective Health, we created an informal networking group called Utah Wonder Women in 2013.

We recognized the need for a cross-sector women’s network anchored around the idea of women supporting women. We had speaker events, book parties and even one full-day conference, but with no backbone organizational structure to sustain it. Then Covid hit, and our live gatherings ended. I went to my co-founders and offered to take it over, fund it and move us to virtual events while we waited out the pandemic. That is how ShePlace was born.

At the same time, I continued to write a lot about money on my personal blog and LinkedIn. I started a newsletter called SheInvests which later became SheMoney, as I wanted to write about more than just investing. My following on LinkedIn grew to hundreds of thousands. There was clearly interest in what I was writing about: money. I gave up trying to track the number of speeches, media appearances, panel discussions and more I have done over the past 30 years, but the throughline was always women, money and social change. A highlight for me was giving a talk at TEDxWomen in 2012 on this theme. I never thought of this as a business, but rather as my purpose.

Act III

The decisions to create ShePlace and SheMoney are a result of a lifelong interest and commitment to do what I could to move in the direction of greater gender equality, both at a micro level and at a macro level.

I have worked as a financial professional, a nonprofit leader, a philanthropic funder, a board member, an investor, a writer, a speaker and now a founder. As a chronic joiner, I have been, and continue to be, a part of so many women’s networks and communities. While they are all valuable in their own ways, what was missing for me was a focus on money: how we make more of it, spend it, give it and invest it.

Up until this time, I was an investor in money platforms, not a creator of one. One of my earliest direct investments was a financial education fintech called LearnVest, which had a successful exit a few years ago. I have other fintech companies in my portfolio, including IFundWomen and SmartPurse, a Switzerland-based financial education company.

As a data geek, I was well aware that Utah ranks as one of the worst states in terms of gender equality. As a proud Utahn, I felt I was not doing enough to create positive change in my home state. So, in my late 50s, with what already was a full docket of activities to fill my time, I took a deep breath. In partnership with COO Madison Limansky, we launched SheMoney as a sister company to ShePlace at an event called SPEND in November 2022.

I believe our purchasing power is our most underused financial tool to create positive social change. We paired this idea of intentional consumerism with 70+ women-owned businesses right here in Utah. The event featured a photo wall of these business owners, and we produced a beautiful guide to facilitate intentional spending. All of this was at no cost to the business owners, and we are now hosting several events catered toward meeting the needs of these business owners that are also open to our members and the public more generally.

Events will continue to be a big part of what we do, both in person here in Utah and virtually. I will tap into my vast network of experts and bring the best to our platform. We will create, curate and share content in multiple ways across our 7 Money Moves, with a big focus on investing. Expect more guides, books and other products that seek to normalize the combination of women and money. My favorite piece so far is our A$$ETS boyshorts underwear.

We launched ShePlace in May of 2021, and since that time, it has grown to over 1,000 community members. We have been fortunate to have incredible public and private support, including partners such as the state of Utah, The University of Utah, Key Bank, Comcast, Catalyst Opportunity Funds and In the Event, to name a few. We are thrilled to have Zions Bank as our lead sponsor for 2023.

While we aspire to be a successful business in our own right, our bigger goal is to link our success to the financial success of all Utah women+, supporting our community on the path to greater financial wellness and freedom. We are proud to work alongside initiatives such as Bolder Way Forward, which seeks to accelerate progress toward gender equality in Utah.

ShePlace—in addition to being a free network designed for women looking to connect with and support other women—is also a network of networks. We have opened our platform to other groups to expand their reach and more affordably connect their current members to other groups. Existing networks we proudly host on our platform include Women Who Succeed, Women’s Leadership Institute, Park City Women’s Giving Fund, Womenpreneurs and Women of The World. We are planning to onboard additional groups this year.

We are just getting started and are so proud to be anchored here in Utah, which is known for being a great place to start and grow a business. Now, we just have to make it a great place for women to start and grow their businesses and an opportunistic place for women to live, work and prosper.